Why We Looked Into This? »👀

|

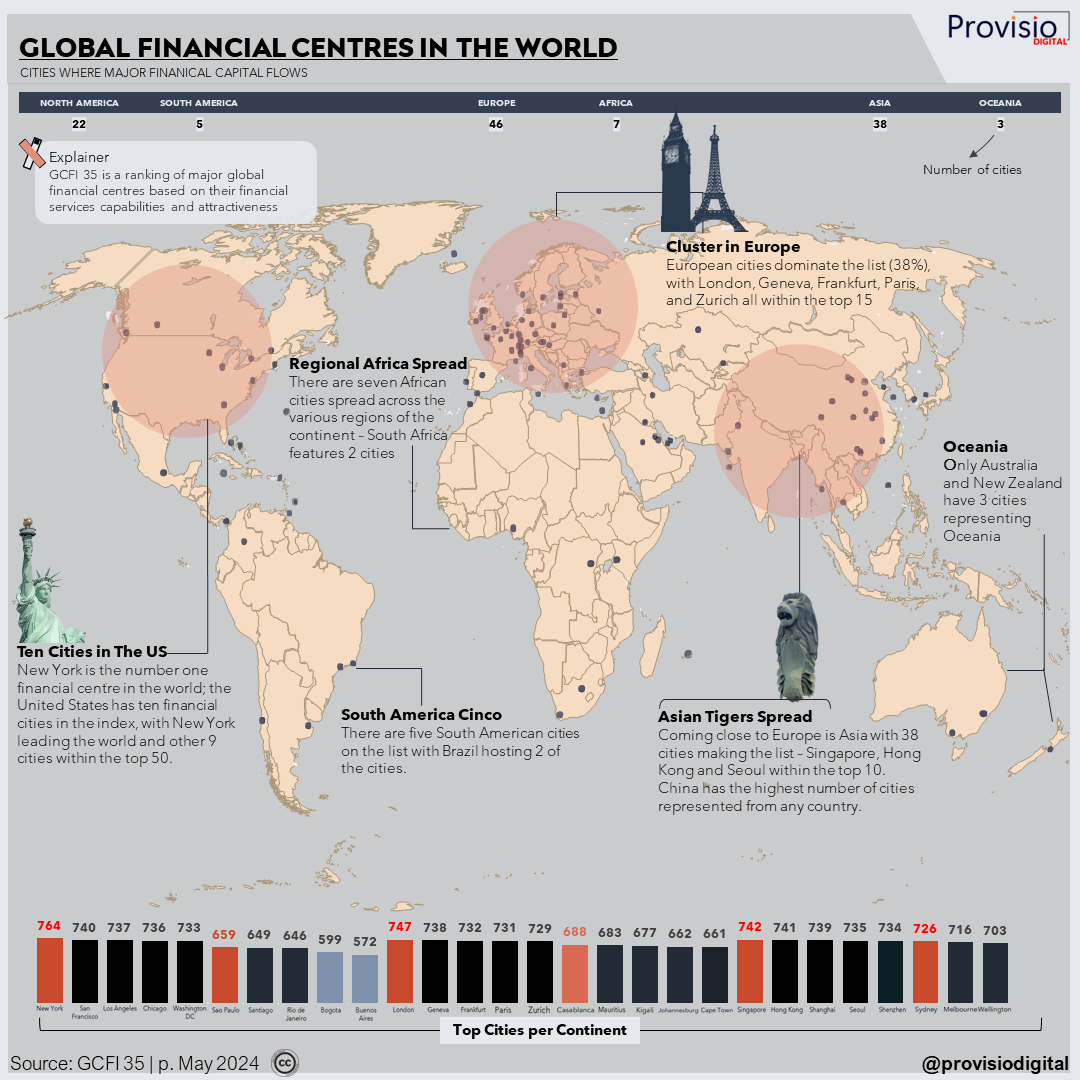

Global Financial Centres in the World – A History

International Financial Centres provide low transaction costs, easy access to capital, qualified labor force, political stability, and dynamic business eco-system. Historically, financial centres emerged in response to economic crises such as the banking or currency crises and this led to the formation of financial centres like London and New York. Trade practices, colonialism and expansion of empires influenced the expansion of cities like Hong Kong and Singapore emerging as crucial financial hubs under British colonial rule. Today, due to the integration of global markets, financial centres act as gateways for the integration of global markets. Formal financial institutions, such as stock exchanges and central banks define successful financial centres by creating a structured environment for financial transactions and risk management, thereby enhancing the attractiveness of cities as financial centres.

Analysis of The Data – Research Findings

- New York remains firmly at the top of the global financial centres ranking with a score of 764, reinforcing its status as the world’s financial powerhouse. The city’s diverse financial ecosystem, including banking, securities, and technology, contributes significantly to its leading position.

- European cities dominate the middle ranks of the list, with Frankfurt, Paris, and Zurich all within the top 15. London, despite Brexit uncertainties, holds the second position globally with a score of 747, showing little impact to the city as a global financial hub.

- Leading the Asian Tigers is Singapore, ranked third with a score of 742. The rapid growth of Chinese financial centres is evident as Shanghai, Shenzhen, and Beijing all rank within the top 15. China has the highest number of cities (12) represented from any country, followed by U.S with 10 cities.

- Cities from Africa are represented across the regions of the continent, with Casablanca being the highest-ranked at 56th. South Africa features 2 of the cities from Africa.

- South America is represented by 5 cities with Brazil hosting 2 of the cities. Australia leads Oceania with two of its cities ranking among the three cities represented from the continent on the list.

- Cities in Asia are increasingly representing the future of global finance, with 15 cities from the continent making the top 30, underscoring the shifting dynamics in economic power towards Asia.

African Cities on The Index

-

- The African cities on the the list spread across the North to the South, East to West. The city of Casablanca, Morocco leads the way, while Mauritius and Kigali (from Rwanda) from East Africa follow. South Africa has two cities on the list – Johannesburg and Cape Town closely following each other while Kenya and Nigeria complete the African representation with Nairobi and Lagos respectively.

- All African cities on the list appear within the top 100 (Lagos is ranked 100 with a score of 632).

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.