Why We Looked Into This? »👀

|

The Beginning

Prior to the return to democratic rule in Nigeria, there had been some impediments to the ease of doing business in the telecoms industry. Among these included:

- Inability of foreign players (non-Nigerians) to participate

- High import duties on telecom equipment

- Complex procedures for importation of telecom equipment into the country

- Inadequate fiscal incentives for local manufacturing

After a 3-day exercise, the Digital Mobile Licence (DML) was auctioned by the industry’s regulator, the Nigerian Communications Commission (NCC) on January 19 2001 . While the asking price for the licence was reserved at $100 million, each licensee paid nearly thrice the price – $285 million. A pioneer status was granted to the initial participants and the licence was valid for an initial period of 15 years.

The year before, in a bid to encourage private investment in the industry, the government of Nigeria wanted established players to jump-start the market. As narrated by the then Director-General of the Bureau of Public Enterprises, Mallam Nasir El-Rufai, UK operator, Vodafone had been offered the licence for $1 but based on their market projections, such investment was not worth it. It is worthy to note that there had been some attempts by the military government to setup the industry which led to the liberalization.

August Launch Date

August is a special month in the Nigerian Telecoms industry. On the 5th of August 2001, Econet Wireless launched its services to the Nigerian marker. Few days later, MTN followed. This is a special look into the GSM market in Nigeria which accounts for 99% of the industry share. Starting with 450,000 active lines, there are over 190 million active lines today in Nigeria.

- August is the favorite launch date for the GSM operators.

- Both Airtel and MTN launched in August 2001 while Globacom launched in August 2003.

- Etisalat launched in October 2008.

Note: Launch date is different from date of incorporation

Evolution

- Telecoms industry contributes an average of 10% to the nation’s GDP.

- Only MTN and Globacom have not gone through a name/ownership change.

- The GSM market accounts for at least 99% of the industry share. Others are VoIP, Fixed and Mobile (CDMA).

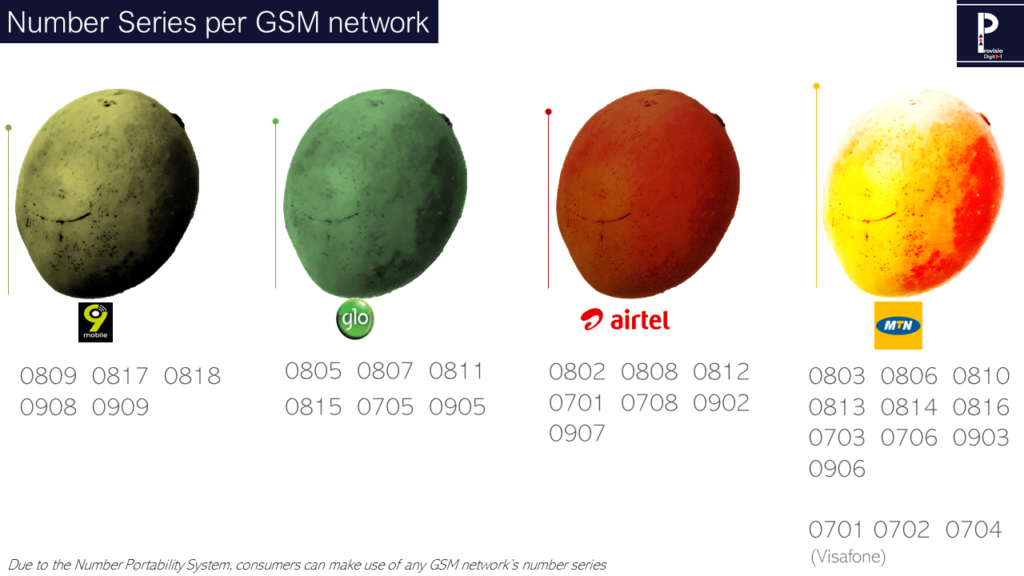

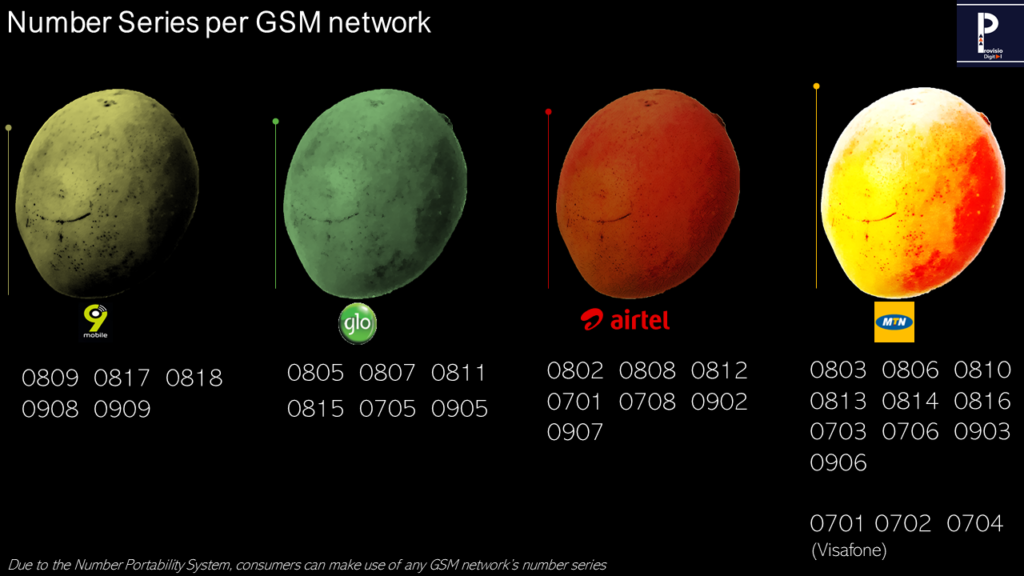

Number Series

- The first additional number series by each network operator was launched in the month of May.

- MTN launched its 0806 series in the month of May, 2005.

- VMobile (Airtel) launched its 0808 series in the month of May, 2006.

- Globacom launched its 0807 series in the month of May, 2006.

- At a point in time (2006-7), Globacom was competing with Airtel in the release of new number series.

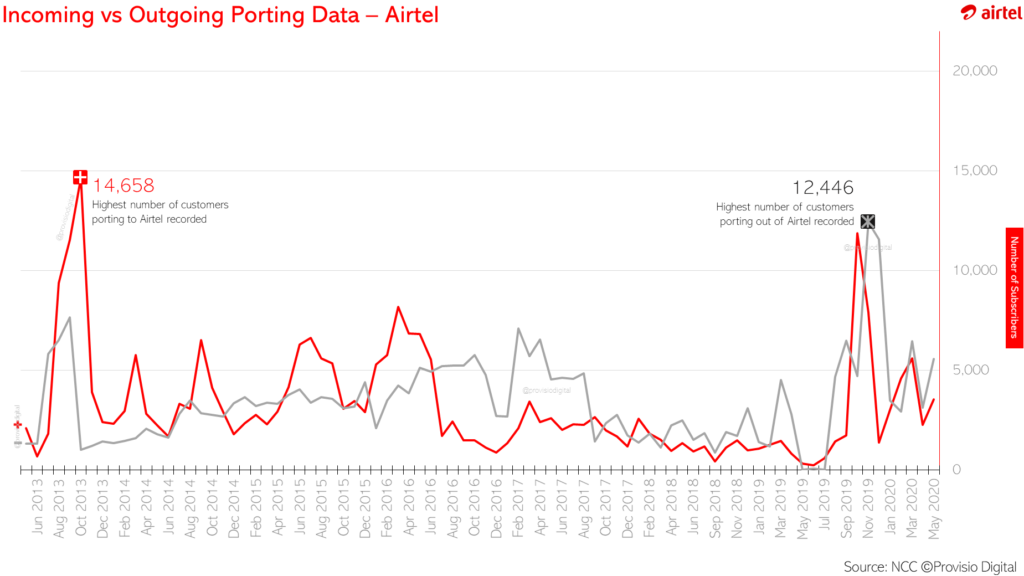

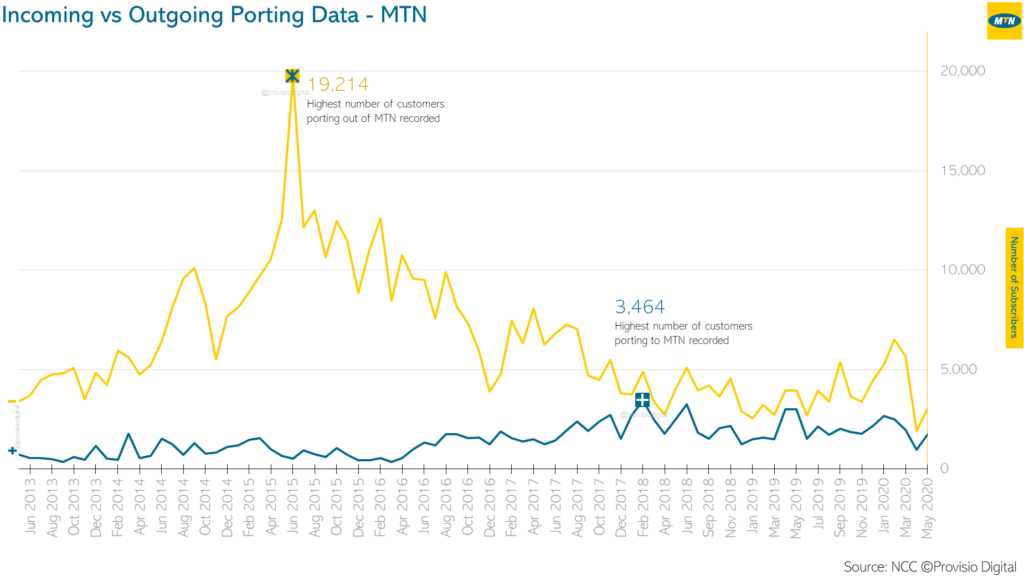

Porting Data – Number Portability

- In January 2012, the Number Portability infrastructure was setup through the launching of the Number Portability Clearing House.

- On April 2013, mobile number portability (MNP) service was unveiled for GSM network subscribers by NCC.

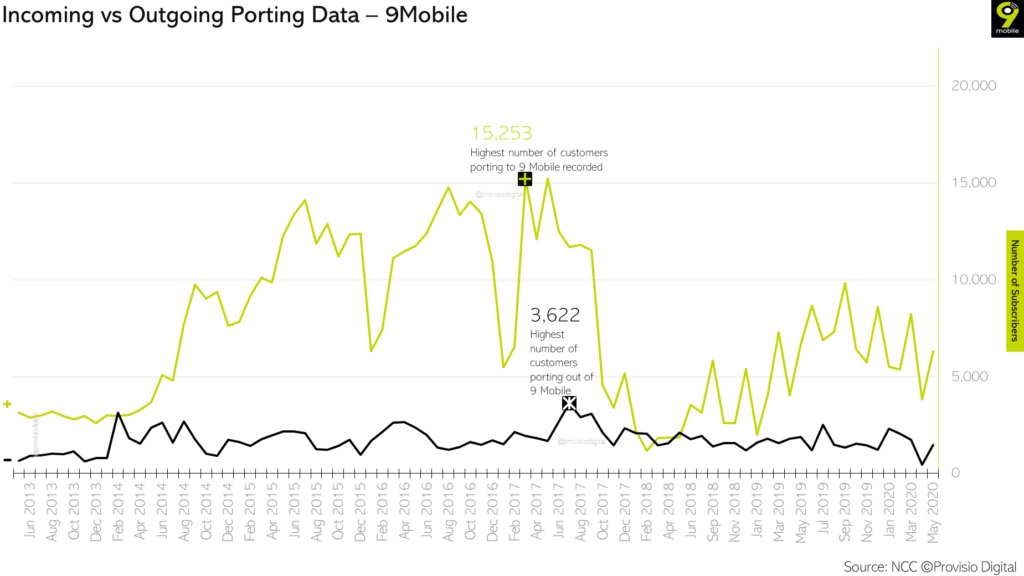

- 9 Mobile has the highest porting activity (incoming and outgoing) – the total incoming data for the other networks when added, does not match 9 Mobile’s.

- Globacom had the lowest number of incoming customers (97,331), followed by MTN (124,067).

- MTN had the lowest number of outgoing customers (426,104) followed by Airtel (299,348).

- October 2013: Airtel recorded the highest number of subscribers (14,658) that joined from other networks.

- November 2019: Airtel recorded the highest number of network users (12,446) that left the network for other networks.

- February 2018: MTN recorded the highest number of subscribers (3,464) that joined from other networks.

- June 2015: MTN recorded the highest number of network users (19,214) that left the network for other networks.

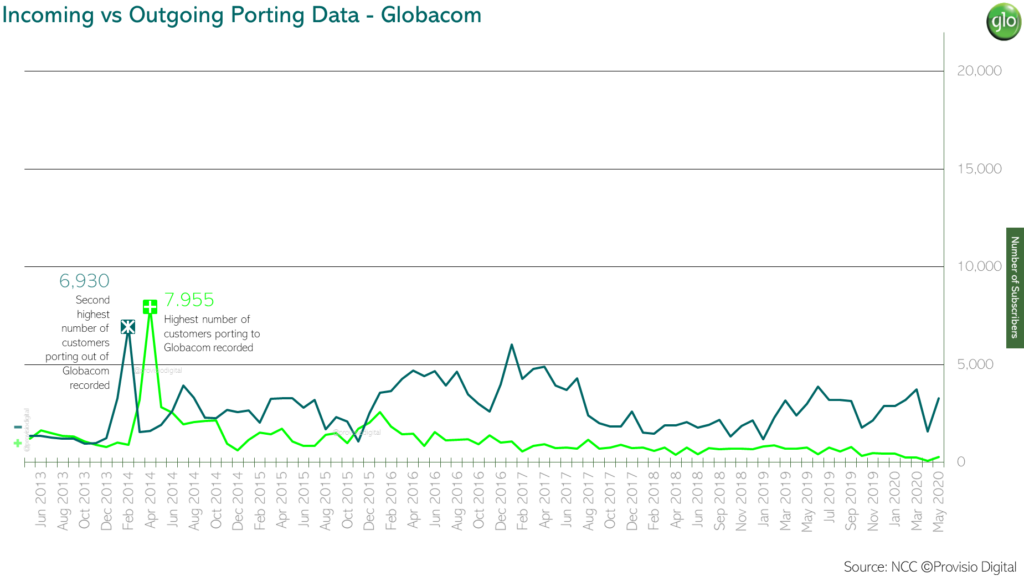

- April 2014: Globacom recorded the highest number of subscribers (7,955) that joined from other networks.

- February 2014: Globacom recorded the second highest number of network users (6,930) that left the network for other networks. The highest was recorded recently in June 2020 – 7,234 subscribers.

- March 2017: 9 Mobile recorded the highest number of subscribers (15,253) that joined from other networks.

- July 2017: 9 Mobile recorded the highest number of network users (3,622) that left the network for other networks.

- June 2017: Etisalat officially exited Nigeria on the 30th of this month.

Market Share Today

- MTN is the market leader followed by

- Glo

- Airtel

- 9 Mobile

Orange’s Attempt

- Orange is a French telecom company with presence in Europe, Middle East and Africa.

- When Etisalat exited Nigeria in 2017, Orange Telecom was reported to have indicated interest in the purchase of the operator in Nigeria.

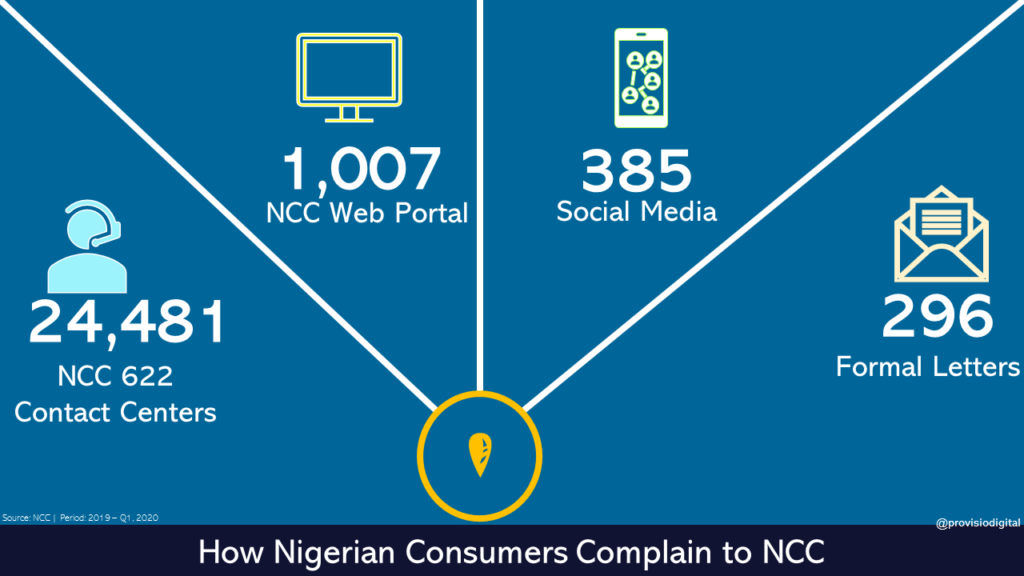

Consumers Top Complaints

- 94% of consumers used the NCC Contact Center (622) to complain about services

- 4% used NCC’s consumer portal

- The remaining 1% were via social media and formal letters.